In the crypto community, "mining" refers to the practice of validating transactions on a blockchain in exchange for tokens. With this incentive, miners create and release new currencies into circulation. Central processing unit (CPU), graphics processing unit (GPU), and application-specific integrated circuit (ASIC) are all used in the mining process. Mining is done to verify bitcoin transactions and display proof of work, with the results being recorded in a block on the blockchain. A mining rig, also known as a Bitcoin mining app, is used to run a node for this process.

Bitcoin functions as a decentralized banking ledger, a record of transactions held in numerous locations at once and updated by contributors to the network, in contrast to a centralized physical bank. The term "blockchain" describes this ledger. To keep the blockchain, which records Bitcoin transactions, current, new blocks of data are added to the chain. Blocks of new transactions can only be added to the blockchain if miners calculate the correct random numbers to solve a difficult equation established by the blockchain system. Then, according to the rules embedded in Bitcoin's code, the miner receives a reward in Bitcoin. Processing quickly increases the number of possible solutions to the blockchain's equation, increasing the likelihood that one of them will be accurate. In order to receive the reward for their computer efforts, miners must be the first to solve the problem. A set of transactions (or block) is added to the ledger once a miner discovers the solution. Bitcoin, the first decentralized digital currency, has seen its value and popularity soar since its creation in 2009. Your chances are proportional to the computational power of other miners and your own.

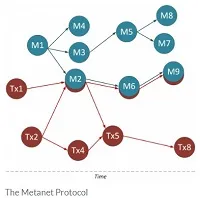

In order to verify cryptocurrency transactions, miners must perform difficult arithmetic and cryptographic operations according to a predetermined algorithm. The majority of miners today work together in mining pools. Algorithms, difficulty levels, hashrates, and reward structures are only some of the variables that affect mining profitability. The goal of a blockchain's miners is to locate the next block by utilizing a predefined hashing algorithm to uncover the corresponding target hash. It is impossible to decrypt data encrypted with a hashing function. After a block has been mined and consensus has been reached across the network, the mempool (a decentralized database that stores pending transactions) is bundled into the block. This procedure is repeated for the next unit. Miners must adhere to a number of procedures. Proof-of-work (PoW) is a technique for verifying transactions and conducting mathematical computations; other systems, such as proof-of-stake (PoS) and proof-of-authority (PoA), were created later. When one party (the prover) demonstrates to another (the verifiers) that a specific amount of computational effort is expended, this is called a proof of work (PoW), a type of cryptographic zero-knowledge proof. Cryptocurrency miners are the nodes in a distributed network.

Mining Rig:

A typical rig will have a motherboard, central processing unit, graphics processing unit, random access memory, storage device, and power supply. Over time, miners have developed more sophisticated systems and specialized tools to increase their output per unit of time. The ability to pool together multiple high-end graphics cards to handle numerous equations simultaneously. The cost of mining typically rises as a result, as more energy, improved cooling, and a mechanism to vent all that heat are required. The solution requires a 64-digit hexadecimal number, which the miners must generate. The reward for a given block goes to the first miner who successfully guesses a number (or hash) that is equal to or less than the target.

Cryptocurrency Mining:

Cloud Mining:

In cloud mining, you pay a service provider (often a large organization) to "rent out" their mining hardware (known as a "rig") and to do the mining operations on your behalf. Typically, cloud mining service providers use tens or hundreds of mining rigs across several farms at their vast data centers.

CPU Mining:

To mine cryptocurrencies, computer processors (CPUs) are used. Processing power miner is VERY sluggish. Although your income is low, your energy and cooling costs are likely ten times higher. You just need access to a desktop computer. A PC and some mining software are all that's required for CPU mining. It's doable on a laptop, but the machine will likely overheat and die in a few hours.

GPU Mining:

The widespread use of GPU mining can be attributed to the success and low cost of this strategy. The GPU mining machine is fantastic because of its hash rate and the overall workforce. Graphics processing unit rigs rely on video cards to mine cryptocurrency. You can start making cryptocurrency with a GPU mining hardware and a miner like Minergate.

ASIC Mining:

The process of crypto mining requires specialized hardware known as ASICs (Application-Specific Integrated Circuits). Because of how strong ASICS are, they make it impossible for miners utilizing GPU or CPU rigs to stay up in hash rates and profits.

The two most popular choices appear to be graphics processing units (GPUs) and cloud mining. Although ASIC mining has the potential for great volatility, CPU mining is sluggish and laborious. Cryptocurrency mining boils down to nothing more than the solution of extremely difficult mathematical puzzles. If you can do it quickly enough, you'll get a coin. You don't receive one if you're not faster than the other applicants. This approach is known as "proof of work." It's not necessary to mine every cryptocurrency. Unlike Bitcoin and Ethereum, which rely on "proof of work," cryptocurrencies like Cardano and Ripple use "proof of stake." The blockchain is still used for transactions, but instead of "mining" new blocks, you "stake" them for security purposes. Like proof-of-work blockchains, proof-of-stake networks are validated by a distributed community. Proof of stake chains use "validators" who stake money to gain more, as opposed to "miners" who mine. To gain the privilege of validating a certain number of transactions on the blockchain and the accompanying network fees, validators stake or lock up funds. Many lone miners never get around to getting the tools they'd need to mine a block on their lonesome. They join mining pools to increase their chances of making a profit. Mining hardware is a major factor in determining which cryptocurrency is the best to mine. A mining calculator can help you estimate your earnings from mining several cryptocurrencies, or you can simply use a program that mines the coin that is currently the most profitable to mine.